Martin Guzman had his first speech yesterday. While no policy definition was made. Some aspects could be read, either explicitly or between the lines.

- The fiscal surplus is a midterm objective but not in the short term. Fiscal measures will most likely come from the income side. “Solidarity and output recovery” was the title of the upcoming announcements, most likely with new taxes and some short term spending impulse.

- However, Guzman criticized Macri’s new pension system indexation rule, claiming that it let the pensioners worst that the previous one (something that is not correct). He may be planning a new (des) indexation rule.

- He insisted that there are no excess resources to finance an expansionary fiscal policy and that Central Bank money printing was not going to be abused. As we stated in our special Report: Helicopter Money, monetary financing is the biggest source of short term risk in Fernandez’ macro.

- He stated that “Argentina has willingness but no capacity to pay” the debt, that we are on a “virtual default” and that the fiscal framework will have to match the new restructured debt path.

- ‘Consistent macro plan” was mentioned many times. We are eager to know more about the details of the plan – or even the thick strokes – but we believe something similar to what we have described as “Consistent Plan” in our Special Report: Shock vs Gradualism may show up, at least as an objective.

In the meantime, we fill our view of debt dynamics – see special report: the Path of least resistance– for 2020-2023 with a missing piece: Debt Sustainability Analysis. How can debt ratios look like under a consistent program scenario?

We simulate debt dynamics based on the “Consistent plan” macro and restructuration scenario we described in our Special Report: The path of least resistance (See Appendix).

Macro Assumptions

We assume that the net post-restructuring financing GAP (10.4% of GDP – net debt principal 3.6% and interest payments 6.8%) is financed with :

- 4.0% from primary surplus: 1.0% on average – feasible but politically unlikely. – see appendix.

- 4.5 from Central Bank Financing: Averaging a moderate 1.1% per year – See special Report: Helicopter Money.

- Net reserves 2.2% of GDP

We find that Debt to GDP may fall to <40% even under the conservative assumptions of growth and fiscal primary surplus. The main ingredients for reducing debt from a starting point of 44.7% of GDP at 2019 year-end to 35.8% (8.9% reduction) are:

- 3.7% by the inflation impact on Local Currency Debt. The main source of the increase in the nominal GDP is inflation. In our Base Scenario, we forecast inflation averaging 36% annually for the next four years. As a result, local currency debt not indexed of around 5.6% will significantly reduce as a share of GDP.

- 1.0% with growth. With accumulated forecast growth of about 2.9% of GDP for this period%.

- 3.6% by net payments of the principal of bonds: 2.8% foreign currency bonds and 0.9% local currency bonds.

Debt % GDP Projection – Base scenario

It is important to mention that risk seems balanced:

- Upside risk:

- A competitive REER reduces the risk of a sharp depreciation and its effects on increasing debt as a share of GDP: 10% of appreciation of the REER results in 3pp lower debt to GDP.

- Inflation could be higher increasing the inflationary erosion of debt in ARS without indexation and increase the inflation tax: 10pp of inflation results in -0.3% of less debt as a % of GDP

- Downside risk

- The highest risk lies in fiscal consolidation not advancing: 1% of additional fiscal deficit results – as expected – in 1% higher debt to GDP ratio.

- And finally, we can experience less growth than the assumption: 1% of growth results in 0.45% debt as a % of GDP

| Appendix 1: Sensitivity analysis Growth  Inflation  REER  Primary deficit  |

| Appendix 2: Starting point Real Effective Exchange Rate  The official REER is on the same level as it was in January 2014, when the domestic currency depreciation took place. On the other hand, the Blue Swap Chip REER is slightly above the 2012-2015 average (ARS 75.3 vs. ARS 67.8). Primary fiscal result The official REER is on the same level as it was in January 2014, when the domestic currency depreciation took place. On the other hand, the Blue Swap Chip REER is slightly above the 2012-2015 average (ARS 75.3 vs. ARS 67.8). Primary fiscal result 2019 will end with the minor primary deficit since 2011, showing signals of a considerable consolidation. It is probably, that in 2019 the primary fiscal deficit will end at 0.5% the lowest level since 2011 and representing a significant improvement since 2015 when it recorded -4.1% of GDP. The effort was considerable because there were also reduced income as a share of GDP in the same period for about 19.9% to 17.9%.Debt as a share of GDP 2019 will end with the minor primary deficit since 2011, showing signals of a considerable consolidation. It is probably, that in 2019 the primary fiscal deficit will end at 0.5% the lowest level since 2011 and representing a significant improvement since 2015 when it recorded -4.1% of GDP. The effort was considerable because there were also reduced income as a share of GDP in the same period for about 19.9% to 17.9%.Debt as a share of GDP As Guzman has recently appointed, the level of debt of GDP is not high when we compared with our regional peers. Also, net private debt is just 45% as a share of GDP. As Guzman has recently appointed, the level of debt of GDP is not high when we compared with our regional peers. Also, net private debt is just 45% as a share of GDP. |

| Appendix 3: Restructuration We simulate financial needs for 2020-2023 in a restructuring scenario with the following assumption (1) Interest payment in local law bond (USD 3.3bn per year) are cut by 50% (2) 20% of Interest and capital payment for international law (USD 4.3bn and USD 3.1bn respectively per year) are reprofiled after 2023 (3) Local law bond amortization (average USD 5.8bn per year and USD 11.4bn in 2020) is reprofiled after 2023. (4) USD Letes are changed for a bond and paid after 2023 (5) 20% of ARS Bills are paid each year and the rest is rolled over (either voluntarily or by force) (6) We don’t have to make any haircut assumptions for this exercise so we do not. (7) We exclude IMF amortization |

Appendix 5: Post restructuring – Financial program  |

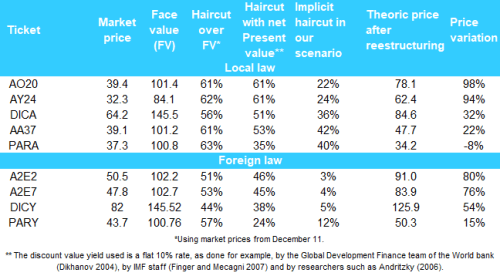

Appendix 6: Bonds price |